Indonesia’s Rise as Southeast Asia’s Next Medical Hub

Indonesia’s healthcare industry is undergoing a major transformation, driven by significant investments and infrastructure expansion. With the recent $157 million investment in Mayapada Healthcare Group and the upcoming launch of Bali International Hospital in the second quarter of 2025, Indonesia is positioning itself as Southeast Asia’s next medical hub, making it a serious competitor in the region’s medical tourism industry.

But can Indonesia truly become Southeast Asia’s next medical hub?

This article explores the key healthcare developments, challenges, and future potential shaping Indonesia’s journey toward becoming a regional leader in medical services.

The Rise of Indonesia’s Healthcare Industry

Over the past decade, Indonesia has taken significant steps to improve its healthcare system. Indonesia’s new health law, officially known as Law No. 17 of 2023, came into effect on August 8, 2023. It replaced the previous health law, Law No. 36 of 2009, and introduced significant reforms to the healthcare system, including provisions for telemedicine, foreign medical professionals, and healthcare funding (International Trade Administration, U.S. Department of Commerce, 2023).

Moreover, the implementation of BPJS Kesehatan, Indonesia’s universal health coverage program, has expanded medical access for millions. As of 1 March 2024, the number of National Health Insurance (JKN) participants has reached 268.74 million people or 96.28% of the total population (Azhar, 2024).

Now, private sector investments are accelerating the country’s progress. These are bringing advanced medical facilities, cutting-edge technology, and highly trained specialists to the forefront. These developments aim not only to improve healthcare for locals but also to attract international patients who might otherwise seek treatment in countries like Singapore, Thailand, or Malaysia.

Major Healthcare Developments & Strategic Investments

1. Bali International Hospital: A Game Changer for Medical Tourism

Set to open in the second quarter of 2025, Bali International Hospital (BIH) is expected to redefine Indonesia’s medical tourism industry. The hospital will focus on specialized treatments in cardiology, oncology, orthopedics, and cosmetic surgery, aiming to reduce outbound medical travel while drawing in international patients (Travel and Tour World, 2024).

📌 Why it matters:

Location Advantage: Situated in Bali, one of the world’s top tourist destinations, BIH offers high-quality healthcare with the added benefit of a vacation-like recovery environment.

Reduced Medical Travel: Many Indonesians travel abroad for specialized care, but BIH aims to offer world-class treatments locally.

International Standards: BIH is designed to meet global healthcare standards, making Indonesia more competitive in Southeast Asia’s medical tourism market.

2. Mayapada Healthcare Group’s Expansion: $157 Million Investment

One of Indonesia’s largest private hospital networks, Mayapada Healthcare Group or Sejahteraraya Anugrahjaya Tbk PT, has received a massive $157 million investment from the U.S.-based private investment firm Bain Capital to expand its facilities, services, and medical technology (Reuters, 2024).

Founded in 2008, Mayapada Healthcare Group operates a growing network of premium hospitals to meet Indonesia’s increasing demand for high-quality healthcare. It has seven hospitals spread across Indonesia, including a flagship hospital in Jakarta Selatan, serving a large segment of Indonesia’s population, particularly on the densely populated island of Java.

📌 Why this is a big deal:

More Specialized Care: The investment will help increase the availability of specialized treatments, reducing the need for Indonesians to seek healthcare overseas.

Advanced Medical Equipment: With access to state-of-the-art technology, Mayapada’s hospitals can offer more accurate diagnoses and treatments.

Regional Competition: This expansion allows Indonesia to compete with Singapore, Malaysia, and Thailand, which have traditionally been preferred destinations for medical treatment.

3. Government Support for Healthcare Infrastructure

The Indonesian government is also playing a vital role in the healthcare transformation, focusing on:

✅ Public-private partnerships to expand medical services

Some of the notable partnerships of the Ministry of Health (MoH) includes:

International Finance Corporation (IFC)

On May 15, 2023, the MoH and the IFC launched the Indonesian Health Sector Growth Program to strengthen Indonesia’s healthcare sector.

The partnership aims to enhance resilience, attract foreign investment, and support economic recovery post-pandemic.

Under a memorandum of understanding (MoU), IFC will provide advisory services and financing to pharmaceutical, vaccine, and medical technology companies while also collaborating with international healthcare organizations to facilitate foreign direct investment in Indonesia’s private health sector.

Accreditation Council for Graduate Medical Education (ACGME), ACGME International (ACGME-I)

In 2024, the ACGME, ACGME-I, and MoH partnered in the “Expansion and Enhancement of Post-Graduate Medical Education for Medical Specialists in the Republic of Indonesia” as part of the Indonesian Health System Transformation.

Through this collaboration, ACGME Global Services will assess Indonesia’s post-graduate medical education landscape and leverage its global expertise to improve the quality of training for resident and fellow physicians.

FIND

On February 2, 2023, FIND and MoH signed a memorandum of understanding (MoU) to expand access to essential diagnostics and strengthen primary healthcare in Indonesia.

The collaboration aims to enhance health system resilience, support universal health coverage, and improve health security.

A key focus is combating antimicrobial resistance (AMR) by implementing diagnostics and digital solutions to reduce inappropriate antibiotic use in both primary care and hospitals. The partnership will also strengthen AMR surveillance initiatives.

✅ Medical Special Economic Zones (SEZs) to attract global investors and professionals

The Indonesian government has established two new Special Economic Zones (SEZs) to boost economic competitiveness, create jobs, and attract investment (ANTARA News, 2024).

1. Banten International Education, Technology, and Health SEZ (Tangerang, 59.68 ha) focuses on education, digital health services, and technology development. With an investment target of Rp18.8 trillion (US$1.1 billion), it aims to host a global-class university, 100 startups, and an integrated health sector, creating 13,446 jobs.

2. Batam International Health Tourism SEZ aims to position Batam as a medical tourism hub, with an investment target of Rp6.91 trillion (US$440 million) and a projected 105,406 jobs. Expected to be operational by 2026, this SEZ could help save Rp500 billion in foreign exchange reserves by reducing outbound medical tourism.

These developments aim to enhance healthcare accessibility, reduce outbound medical travel, and position Indonesia as a competitive regional healthcare hub. Looking forward, these efforts signify a transformative era for the nation’s healthcare infrastructure and economy.

Indonesia’s Healthcare Industry: Challenges and Opportunities

Despite rapid progress, Indonesia still faces key challenges in its journey to becoming a leading medical destination:

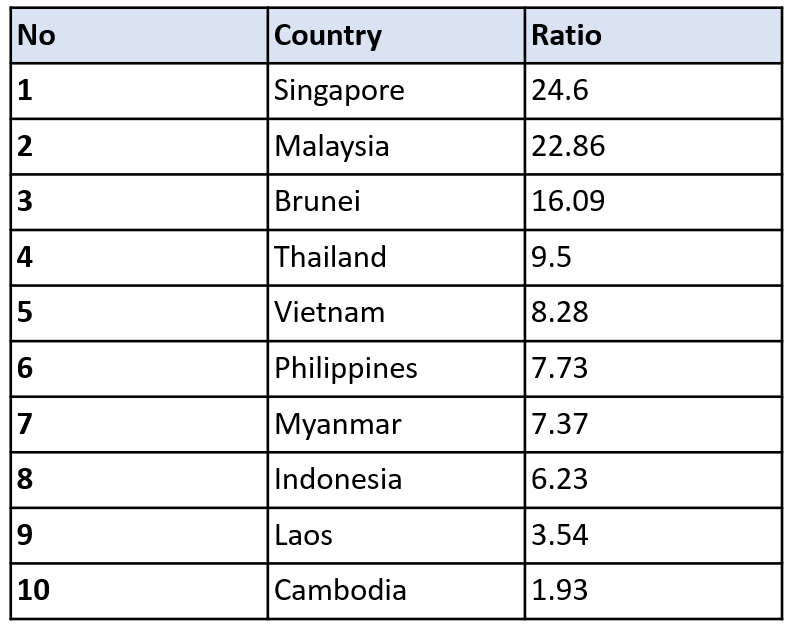

1. Shortage and uneven distribution of medical professionals

The table indicates a significant shortage of doctors in Indonesia, with 6.23 per 10, 000 people, below the WHO standard of 10 per 10, 000 (Prananingrum et al., 2023).

Moreover, the distribution varies by profession—midwives are more evenly distributed, while specialists and dentists face significant disparities, particularly at the district level (Muharram et al., 2024).

To address the shortage, the House of Representatives (DPR) passed Law Number 17 of 2023 enacted in August 2023, to open the door for foreign specialist doctors to practice within the country.

However, foreign healthcare workers face challenges including obtaining necessary licenses (STR (Surat Tanda Registrasi) and SIP (Surat Izin Praktik)), language barriers, cultural differences, and potential difficulties in finding adequate housing and amenities, especially in rural areas (Putri, 2023).

2. Healthcare regulations and licensing

Navigating the regulatory landscape in Indonesia presents certain challenges, including complex documentation requirements, frequent regulatory updates, and language barriers since regulatory submissions and communications with authorities are typically conducted in Bahasa Indonesia (Mursmedic, 2024).

Example: Halal certification of medical products

Indonesia has strict Halal certification requirements for medical devices, medicine, biological products, and health equipment, but the certification process for MedTech products remains unclear. Costs vary based on product type, raw materials, factory locations, and labeling requirements. While Mutual Recognition Agreements (MRA) on Halal certification exist globally, the mechanism for imported finished products lacks clarity, creating challenges for the MedTech industry (Ramirez, 2024).

Compared to Singapore, English is the main working language, making communication between foreign businesses and their local staff much easier. Singapore is consistently ranked among the top three economies in the World Bank’s Ease of Doing Business report, reflecting its business-friendly environment. The time and cost of setting up a business in Singapore are relatively low. Foreign businesses looking to establish operations must work with a registered filing agent to submit their application via BizFile+, an electronic filing system that integrates tax and business registration requirements into a single form (ASEAN BRIEFING, 2024).

The Indonesian government has implemented several measures to address these challenges:

Streamlining Regulatory Processes:

1. E-Registration System: The National Agency of Drug and Food Control (BPOM) introduced an electronic registration system to simplify the application process for pharmaceuticals and medical devices, reducing the time required for product registration and facilitating faster market entry (Mursmedic, 2024).

2. Harmonization with International Standards: BPOM has aligned its regulations with international standards set by organizations like the World Health Organization (WHO) and the International Council for Harmonisation (ICH), ensuring that products approved in Indonesia meet global quality benchmarks (Mursmedic, 2024).

Addressing Language Barriers:

Regulatory Submissions in Bahasa Indonesia: While regulatory submissions are typically conducted in Bahasa Indonesia, the government recognizes the challenges this may pose for foreign entities. Engaging experienced local regulatory consultants who understand both the language and cultural context can facilitate smoother communication with authorities (Pacific Bridge Medical, 2023).

Halal Certification for Medical Products:

1. Regulatory Framework:

The government issued Presidential Regulation No. 6 Year 2023, stipulating that medicines, biological products, and medical devices marketed in Indonesia must obtain Halal certification. This regulation mandates that products be certified free of pork derivatives or other substances prohibited by Islamic law, with compliance required across all business processes, including materials, manufacturing, storage, and packaging (International Trade Administration, 2023).

2. Implementation Guidelines:

To provide clarity, the Ministry of Health released Regulation No. 3 Year 2024 (Permenkes No. 3 Year 2024), detailing Halal certification requirements for medical devices. This includes specifying which medical devices require certification, outlining Halal manufacturing practices, and setting labeling and packaging guidelines (Qualtech, 2024).

3. Transition Periods:

Recognizing the complexities involved, the government has established transition periods for mandatory Halal certification across various product categories, allowing businesses time to comply with the new requirements.

These initiatives demonstrate the Indonesian government’s commitment to enhancing regulatory efficiency and ensuring that medical products meet both international standards and the Halal requirements valued by its predominantly Muslim population.

3. Technological Challenges

Fragmented Health Data Systems: The existence of over 400 health applications developed by various government levels has led to fragmented health data. This fragmentation hampers the development of comprehensive health policies and efficient service delivery (PwC Indonesia, 2023).

Limited Adoption of Digital Health Solutions: Although there has been a rise in digital health services, such as telemedicine, their adoption remains limited. Many healthcare facilities have yet to integrate advanced technologies into their operations, affecting service quality and accessibility.

Low ICT Maturity in Healthcare Providers: The Information and Communication Technology (ICT) maturity of healthcare providers in Indonesia is between basic and good levels, indicating a need for enhanced digital capabilities to support healthcare delivery (Aisyah et al., 2024).

To address these gaps, the government has accelerated the adoption of digital health solutions since the COVID-19 pandemic, including telemedicine. Read more about the government initiatives in bridging healthcare access in this blog.

The Future of Indonesia’s Healthcare Industry

Indonesia is taking bold steps to transform itself into a major healthcare player in Southeast Asia. With increasing private investments, the launch of high-quality medical facilities, and government-backed healthcare initiatives, the country is well on its way to becoming a preferred destination for medical tourism and world-class healthcare services.

📈 What’s Next?

If investment trends continue, Indonesia could rival regional leaders in medical tourism by 2027-2030.

According to Indonesia Hospital Market Analysis, the Indonesian hospital market was valued at $33 billion in 2023 and is projected to expand at a CAGR (Compound Annual Growth Rate) of 7.6% from 2023 to 2030, reaching $55.1 billion by 2030. This growth is primarily driven by the increasing burden of chronic diseases, technological advancements, and government initiatives.

In addition, the ILA Global Consulting, projected a booming Indonesia medical tourism market to reach USD 2.2 billion by 2028.

More international partnerships and technology-driven healthcare solutions will accelerate the transformation

Government support for faster licensing and accreditation will make Indonesia more attractive to foreign patients and medical professionals

Conclusion: Is Indonesia Ready to Be Southeast Asia’s Next Medical Hub?

Indonesia isn’t quite there yet, but it has the right momentum. With Bali International Hospital, Mayapada’s expansion, and government-backed infrastructure projects, the country is positioning itself as Southeast Asia’s next medical hub and a strong competitor in the region’s medical tourism sector.

If Indonesia continues to invest in medical innovation, workforce development, and regulatory improvements, it could soon rival established medical hubs like Singapore and Thailand.

Stay Updated on Indonesia’s Healthcare Evolution!

Want to stay ahead of the latest healthcare trends in Indonesia?

🔹 Follow us for more healthcare insights!

📩 ZAFYRE BLOGS

References

Journal Articles:

- Aisyah, D. N., Setiawan, A. H., Alfiano Fawwaz Lokopessy, Faradiba, N., Setiaji Setiaji, Manikam, L., & Zisis Kozlakidis. (2024). ICT Maturity Assessment at Primary Healthcare Services across 9 Provinces in Indonesia: An Evaluation Study (Preprint). JMIR Medical Informatics, 12, e55959–e55959. https://doi.org/10.2196/55959

- Muharram, F. R., Sulistya, H. A., Swannjo, J. B., Firmansyah, F. F., Rizal, M. M., Izza, A., Isfandiari, M. A., Ariningtyas, N. D., & Romdhoni, A. C. (2024). THE INDONESIA HEALTH WORKFORCE QUANTITY AND DISTRIBUTION. MedRxiv (Cold Spring Harbor Laboratory). https://doi.org/10.1101/2024.03.31.24305126

- Prananingrum, D. H., Prasetyo, A., Yanto, O., & Rinda, A. (2023). A Legal Concept of Post COVID-19 Telemedicine Practices in Foundation and Corporate Hospital. Advances in Social Science, Education and Humanities Research/Advances in Social Science, Education and Humanities Research, 670–681. https://doi.org/10.2991/978-2-38476-164-7_61

News Articles:

- ACGME. (2024). The ACGME and ACGME International to Collaborate with Indonesia’s Health Ministry, Focusing on Graduate Medical Education in the Fourth Most Populous Country in the World. Acgme.org. https://www.acgme.org/newsroom/2024/4/the-acgme-and-acgme-international-to-collaborate-with-indonesias-health-ministry-focusing-on-graduate-medical-education-in-the-fourth-most-populous-country-in-the-world/

- ANTARA News. (2024, October 10). Government establishes new SEZs in education, health sectors. Antara News; ANTARA. https://en.antaranews.com/news/329034/government-establishes-new-sezs-in-education-health-sectors

- Dianti, T. (2024, July 19). Indonesian plan to hire foreign doctors amid severe shortage faces backlash. Benar News. https://www.benarnews.org/english/news/indonesian/backlash-foreign-doctor-hire-plan-07192024154334.html

- Reuters. (2024, December 12). Bain Capital invests $157 mln in Indonesia’s Mayapada Healthcare Group. Reuters. https://www.reuters.com/business/healthcare-pharmaceuticals/bain-capital-invests-157-mln-indonesias-mayapada-healthcare-group-2024-12-12/

- Travel and Tour World. (2024, November 23). Erick Thohir Envisions Bali as a Global Leader in Medical Tourism, With New Hospital Set to Offer Top-Tier Healthcare Services and Wellness Experiences – Travel And Tour World. Travel and Tour World. https://www.travelandtourworld.com/news/article/erick-thohir-envisions-bali-as-a-global-leader-in-medical-tourism-with-new-hospital-set-to-offer-top-tier-healthcare-services-and-wellness-experiences/

Others:

- ASEAN BRIEFING. (2024). Why Singapore – Singapore Guide | Doing Business in Singapore. Www.aseanbriefing.com. https://www.aseanbriefing.com/doing-business-guide/singapore/why-singapore

- Azhar, M. (2024, April 17). BPJS Kesehatan’s strategy to protect 275 million Indonesians with health insurance. Govinsider.asia. https://govinsider.asia/intl-en/article/bpjs-kesehatans-strategy-to-protect-275-million-indonesians-with-health-insurance

- FIND. (2023). FIND and Republic of Indonesia Ministry of Health ink partnership to drive access to essential diagnostic tests – FIND. FIND. https://www.finddx.org/publications-and-statements/press-release/find-and-republic-of-indonesia-ministry-of-health-ink-partnership-to-drive-access-to-essential-diagnostic-tests/

- Gupta, A. (2023). Insights10. Insights10.com. https://www.insights10.com/report/indonesia-hospital-market-analysis/

- IFC. (2023). IFC and Indonesia MoH Partner to Boost the Nation’s Health Sector through Public-Private Cooperation. IFC. https://www.ifc.org/en/pressroom/2023/27524

- International Trade Administration. (2023, September 26). Indonesia Halal Certification. International Trade Administration | Trade.gov. https://www.trade.gov/market-intelligence/indonesia-halal-certification

- International Trade Administration, U.S. Department of Commerce. (2023, September 17). Indonesia Healthcare Law. Www.trade.gov. https://www.trade.gov/market-intelligence/indonesia-healthcare-law

- Mursmedic. (2024, August 14). Unlocking Healthcare Opportunities in Indonesia: Regulatory Insights and Strategies. Mursmedic. https://mursmedic.com/unlocking-healthcare-opportunities-in-indonesia-regulatory-insights-and-strategies/

- Pacific Bridge Medical. (2023, May 1). Asia Medical Device Compliance: Regulatory Guide | PBM. Pacific Bridge Medical. https://www.pacificbridgemedical.com/resources/navigating-regulatory-compliance-for-imported-medical-devices-in-asia/

- Putri. (2023, October 10). Opportunities and challenges for foreign doctors in Indonesia – Integrity Indonesia. Integrity Indonesia. https://www.integrity-indonesia.com/blog/overcoming-medical-workforce-shortages-opportunities-and-challenges-for-foreign-doctors-in-indonesia/

- PwC Indonesia. (2023, February 2). How can technology accelerate the digitisation of the Indonesian healthcare sector? PwC. https://www.pwc.com/id/en/media-centre/press-release/2023/english/how-can-technology-accelerate-the-digitisation-of-the-indonesian-healthcare-sector.html

- Qualtech. (2024, September 17). Overview of Indonesia’s Halal Medical Device Regulation: Permenkes No. 3 Year 2024. Qualtechs.com. https://www.qualtechs.com/en-gb/article/indonesia-halal-medical-device-regulation-permenkes-2024-overview

- Ramirez, H. (2024, October 3). Implications of New Indonesian Government’s Priorities on the MedTech Industry – Speyside Group. Speyside Group – We Are a Global Consultancy. https://www.speyside-group.com/strategic-insights-implications-of-new-indonesian-governments-priorities-on-the-medtech-industry/